pay utah property tax online

Pay for your Utah County Real Property tax Personal Property tax online using this service. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Your signed statement of personal property must be physically submitted to the assessor in order to comply.

. Assuming everything else remains equal an increase in property value would mean a decrease in the tax. You may request a pay plan online at taputahgov by registering for a free account. Your property serial number Look up Serial Number.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Because all payment plan approvals and monthly reminders are sent by email. Rather the base property tax revenue is the same from the prior year.

Payment is made with 45 a dollar fee is required on the remaining 55. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Call 877 690-3729 code 5450 to pay your property taxes by telephone.

File electronically using Taxpayer Access Point at taputahgov. Roger Barth rlbarthutahgov 385-377-4998. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Form of Payment Payment Types Accepted Online. File electronically using Taxpayer Access Point at taputahgov. The various taxes and fees assessed by the DMV include but are.

County Logon Request Form PT-301. 1 of the payment amount with a minimum fee of 100. Be Postmarked on or before November 30 2022 by the United States Postal Service or 3.

Pub 2 Utah Taxpayer Bill of Rights contains additional information regarding taxpayer rights and responsibilities. Online payments do not satisfy the filing requirements as stated in UCA 59-2-307. Online PERSONAL Property Tax Payment System.

Ad Pay Your Taxes Bill Online with doxo. What You Need. Salt Lake County personal property taxes must be paid on or before the deadline for timely payment shown on the tax notice or interest will begin to accrue.

If paying after the listed due date additional amounts will be owed and billed. They conduct audits of personal property accounts in cooperation with county assessors statewide. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

Click here to pay via eCheck. Pay over the phone by calling 801-980-3620 Option 1 for real property. Municipal Certifications.

How Do I Pay My Property Taxes In Utah. If you have questions about your property tax bill or want to make a payment see this document. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Classification Guide PDF Version. In TAP you can also file and pay taxes and manage your account including viewing correspondence we have sent to you changing your mailing address viewing balances and scheduling payments.

This website is not available during scheduled system maintenance. 0 Electronic check payment. In contrast debit and credit cards require you to pay for this service with a fee of 2 percent.

To pay Business Personal Property Taxes. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Most taxes can be paid electronically.

You may also mail your check or money order payable to the Utah State Tax Commission with your return. Follow the instructions at taputahgov. JJ Alder jwalderutahgov 801-573-0131.

You may also pay with an electronic funds transfer by ACH credit. Visit Utahgov opens in new window Services opens in new window. In Utah additional property tax revenue is not a simple matter of raising property values to increase revenue.

See also Payment Agreement Request. Payments This section discusses information regarding paying your Utah income taxes. What you need to pay online.

24 of the payment amount with a minimum fee of 195. UTAH STATE TAX COMMISSION. Nightly scheduled maintenance is done from 1155 PM to 500 AM MST.

Taxpayers paying online receive immediate confirmation of the payments made. Salt Lake County Treasurer. Your business personal property account number.

Commercial Statement of Confidentiality example docx. Filing Paying Detailed information about filing and paying your Utah income taxes. An electronic check payment or e-check has no fee.

Ad Check How to Qualify for the Child Tax Relief Program with Our Guide. Confirmation acknowledges receipt of your information and intent to pay property taxes. Paid online or by phone with a receipt transaction time before midnight Mountain Standard Time on November 30th.

You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Online payments may include a service fee. Please contact your financial institution to verify that funds have been transferred.

Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide. Weber County property taxes must be brought in to our office by 5 pm. Property taxes can be paid online by credit card.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property.

These are the payment deadlines. Your Personal Property Account Number 2. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

You may pay your tax online with your credit card or with an electronic check ACH debit. On November 30 or 2. GenTax and County Books Questions.

To pay Real Property Taxes. Scheduled maintenance times are approximate and may be extended due to unusual circumstances. See Taxpayer Access Point TAP for electronic payment options including setting up a payment agreement.

Steps to Pay Your Property Tax. General property tax information and topics. Classification Guide Tabular Data.

Historical Overview of Utahs Property Taxes. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. Devin Hales dhalesutahgov 385-377-4638.

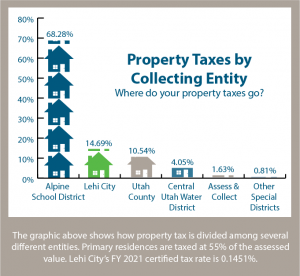

Property taxes help to pay for a variety of public services.

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

State Tax Levels In The United States Wikipedia

Utah Sales Tax Small Business Guide Truic

Interst Rates Are Historically Low Now Is The Best Time To Buy A Home Mortgage Payment Mortgage Brokers Real Estate Advice

How Do Child Support Liens In Utah Work Gary Buys Houses

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Utah State Tax Commission Notice Of Change Sample 1

Utah Property Taxes Utah State Tax Commission

Pay Taxes Utah County Treasurer

Midwestern Fabricators At 1235 South Pioneer Road 2700 West Salt Lake City Ut 84104 For Sale 2 400 000 Desc Acre Commercial Real Estate Salt Lake City

Utah Tax Break Program Could Be A Lifeline For Seniors

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

426 E 1750 N Vineyard Ut 84059 Industrial For Lease Loopnet

Down Payment Assistance Program Utah Gold Canyon Oregon

137 E Twin Hollow Dr Mapleton Ut 84664 Mls 1820733 Zillow In 2022 Backyard Covered Patios House System House Styles

Transaction Summary Template For Real Estate Realtor And Etsy Transaction Coordinator Real Estate Templates Real Estate

Printable Sample Free Rental Application Form Form Rental Application Real Estate Forms Application Form

An Overview Of The Benefits Of Buying A Home Vs Renting Finance Plan Mortgage Interest Rates Home Buying